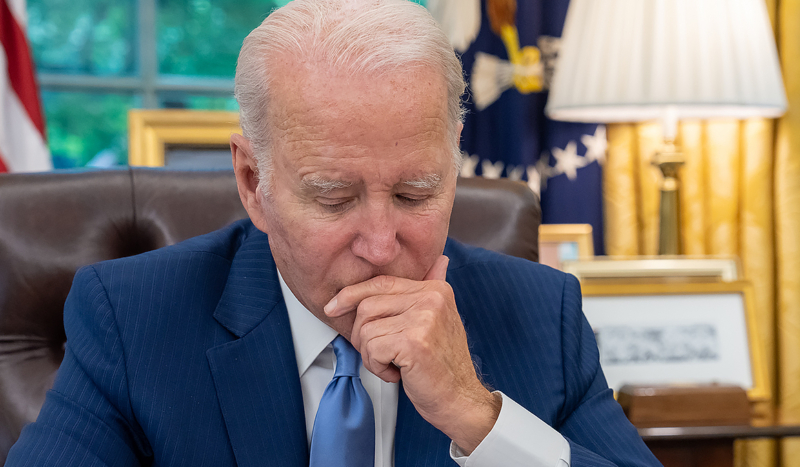

CV NEWS FEED // Data released this week shows that poverty, especially among children, is rising at an astronomical rate, despite President Joe Biden’s promise two years ago to cut child poverty in half.

“President Joe Biden’s war on poverty is unraveling fast,” wrote Politico White House reporter Adam Cancryn in a piece published Wednesday:

Just two years after orchestrating the largest expansion of the U.S. safety net in a half-century, Biden’s $2 trillion bet that big-government policies could vastly improve life for the poorest Americans is coming to a close.

Cancryn went on to cite alarming statistics unveiled by the U.S. Census Bureau on Tuesday.

The data, he wrote,

found that the poverty rate spiked to 12.4 percent in 2022, from 7.8 percent in the prior year, as an array of enhanced federal benefits meant to help families afford food, housing and other basic needs expired one after another. The poverty rate for children alone also hit 12.4 percent, more than doubling from 5.2 percent in 2021.

“The numbers represent a sharp reversal from a year earlier and an erasure of the gains made during the pandemic,” Cancryn continued.

Cancryn credited the American Rescue Plan Act of 2021, a massive spending bill Biden championed, for the initial decrease in poverty. However, this claim has been disputed by many observers.

Writing for The Daily Wire, Ben Johnson showed that the evidence does not corroborate Biden’s promises about his spending programs resulting in reduced poverty.

“He promised his economic policies would create ‘millions’ of jobs, but they did not add a single job to the U.S. economy in 2021,” wrote Johnson. In addition, Johnson pointed out that the president “promised that recrafting the Child Tax Credit as a monthly welfare program would decimate child poverty.”

The fact that the percentage of children living in poverty increased by 138% over two years of the Biden presidency shows that the White House’s promise missed its mark.

Around the time he signed the American Rescue Plan, Biden said that “all told” it

would lift 12 million Americans out of poverty and cut child poverty in half. That’s 5 million children lifted out of poverty. Our plan would reduce poverty in the Black community by one third and reduce poverty in the Hispanic community by almost 40 percent.

CNN at the time cautioned that “these figures are, obviously, predictions rather than guarantees.” The network’s fact-checker explained that the president “got them from a ‘preliminary analysis’ by scholars at Columbia University’s Center on Poverty and Social Policy, which looked at the impact of certain components of his plan.”

“Like other economic modeling, this analysis relied on various assumptions about the future that may not come true,” CNN forewarned.

The president this week blamed “congressional Republicans” for the drastic rise in poverty.

“Today’s Census report shows the dire consequences of congressional Republicans’ refusal to extend the enhanced Child Tax Credit, even as they advance costly corporate tax cuts,” Biden claimed in a statement released by the White House Tuesday.

Sen. Michael Bennet, D-CO, agreed with the president’s talking points, blaming Republicans in Congress for allowing the Democrats’ expansions of the tax credit to expire.

“When we expanded the Child Tax Credit, we demonstrated that we don’t have to accept one of the highest childhood poverty rates in the industrialized world as a permanent feature of our democracy,” Bennet told The Hill on Monday, in anticipation of the Census Bureau’s data.

He said the statistics “will show we never should have let [the credit] expire, and I’m committed to doing everything I can to restore it.”

However, in his analysis, Johnson demonstrated how the belief that Biden’s Child Tax Credit contributed to the initial 2020 decline in poverty is inherently flawed:

In 2021, Joe Biden’s American Rescue Plan transformed the Child Tax Credit into a monthly welfare check. The ARP severed the CTC’s original connection to work or its status as a tax reduction. Parents received 100% of the “tax credit,” even if they owed no federal income taxes, and the plan contained no work requirement.

Perhaps most transformatively, recipients no longer had to wait until the end of the year to receive the credit with its tax refund. Starting last July, families making up to $150,000 a year could bank a “tax credit” of $300 a month for every child under the age of six and $250 for each child aged 6 to 17, deposited directly into their bank accounts, even if they did not work one hour that year.

By one estimate, 80% of the new Child Tax Credit’s benefits go to people who owe no federal income tax.