The White House / Flickr

President Donald Trump’s determination to restore manufacturing in the US and expand market access for American agricultural exports is yielding fruit despite an initial period of anxiety and uncertainty.

The same tariffs that disrupted global trade and the US economy are now making American goods produced in small and mid-size companies “more price competitive with imports for the first time in years,” the Wall Street Journal (WSJ) reported Sunday.

“We are swamped,” said Jack Schron, president of Jergens, Inc., whose company produces industrial tools such as screwdrivers, clamps, and hoists. “We are running 24 hours a day, seven days a week in both Chicago and Cleveland.”

According to the report, Schron’s factories are surging, in part, due to new orders from customers seeking to avoid paying import tariffs.

“[T]he tariffs—especially the 145% tax on Chinese imports—are boosting demand for some U.S.-made goods, with some smaller players reaping the early benefits,” WSJ noted.

The tariffs, however, are also driving large pharmaceutical and biotechnology companies to invest in expansion in America.

In a press statement released Thursday, the White House announced Trump’s plan to draw drug manufacturing and the biotech field back to the US is both “a matter of national security” and an avenue for “unprecedented prosperity for American workers.”

Among those companies announcing new investments in operations within the US are:

California-based companies

- Gilead Sciences will spend $11 billion on US-based manufacturing

- Amgen announced a $900 million investment for its Ohio-based manufacturing operation.

Illinois-based companies

- AbbVie plans to spend $10 billion over the next ten years to build four new manufacturing plants.

- Abbott Laboratories announced a $500 million investment in its Illinois and Texas facilities.

Indiana-based company

- Eli Lilly and Company plans to spend $27 billion to more than double its domestic manufacturing capacity.

New Jersey-based companies

- Johnson & Johnson plans to spend $55 billion on manufacturing, research and development (R&D), and technology

- Bristol Myers Squibb announced a $40 billion investment in R&D, technology, and manufacturing.

- Merck & Co. announced it will invest a total of $9 billion over the next several years. Merck has already broken ground on a new $1 billion manufacturing facility in Delaware, and, in March, completed construction on a $1 billion “state-of-the-art facility to expand vaccine production capacity in Durham, North Carolina,” the pharmaceutical giant said. Merck Animal Health also announced an $895 million investment to expand its Kansas manufacturing facility.

New York-based company

- Regeneron Pharmaceuticals announced a $3 billion manufacturing and supply agreement with FUJIFILM Diosynth Biotechnologies to manufacture drugs at its plant in North Carolina.

Switzerland-based companies

- Roche announced a $50 billion investment in its US-based manufacturing and R&D

- Novartis will spend $23 billion over five years to build or expand ten manufacturing facilities across the US to ensure “all key Novartis medicines for US patients will be made in the United States,” the company said.

The White House also announced on Thursday Trump’s “historic” trade deal with the United Kingdom (UK) will provide “unprecedented access to the UK markets while bolstering U.S. national security.”

“The deal includes billions of dollars of increased market access for American exports, especially in agriculture, dramatically increasing access for American beef, ethanol, and virtually all of the products produced by our great farmers,” the president said in a statement included in a fact sheet.

The White House added the trade deal “will significantly expand U.S. market access in the UK, creating a $5 billion opportunity for new exports for U.S. farmers, ranchers, and producers.”

“An absolutely historic pro America deal by the most pro America President of my lifetime,” Republican Sen. Bernie Moreno of Ohio stated in reaction to the trade deal. “We will no longer be ripped off and will no longer tolerate trade imbalances that have destroyed the opportunities for working Americans.”

Farmers are increasingly optimistic about both “current conditions” and “future expectations,” AgDaily reported Tuesday.

“The Purdue University/CME Group Ag Economy Barometer rose 8 points to a reading of 148, up from 140 in March,” the agricultural industry publication noted. “The Index of Current Conditions climbed 9 points to 141, while the Index of Future Expectations increased 8 points to 152.”

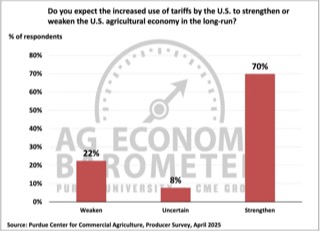

Despite reports, such as that from the New York Post in April that described a “full-blown crisis” among farmers whose Chinese orders of soybeans and pork were cancelled due to the US tariffs, AgDaily observed the barometer especially highlighted that “[n]otably, a majority of producers said they believe the increased use of tariffs will ultimately benefit the U.S. agricultural economy.”

The White House underscored on Wednesday these key takeaways from the barometer’s results:

- 70% of farmers expect the President Trump’s tariffs to strengthen the agricultural economy in the long-term.

- Farmer sentiment improved in April, marked by rises in current and future expectations.

- The Farm Capital Investment Index rose to its highest reading since May 2021.

- “This month, one out of four respondents said it was a good time to make large investments, nearly double the percentage of respondents who said it was a good time to invest when surveyed from May through October of last year.”

- The Farm Financial Performance Index “marked the fourth month in a row that the index was above 100, indicating that producers expect financial performance this year to equal or slightly exceed the year-ago level.”

“American farmers are behind President Donald J. Trump and his relentless push to restore fairness in global trade and secure new markets for homegrown producers,” the White House said.